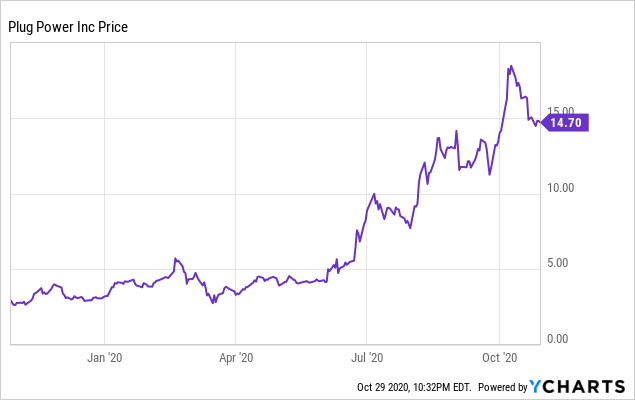

In a recent InvestorPlace column, Vince Martin articulated the case for Plug Power stock. There Is a Bullish Case for Plug Power Stock In other words, to get a modest gain from this penny stock, you’d have to either time it just right, or be willing to ride out some significant volatility. I’m not dismissing a profit, but since March you would have to endure two corrections in a stock that prior to this year has mostly been a falling knife. 2 would be looking at a gain of $1,450 (not counting fees and expenses). Investors who bought 1,000 shares on Jan. In this case, I’m advocating just the opposite. 14, your 1,000 shares would be up almost 35%. But if you didn’t buy on May 2, but got in on Aug. 2, but you got in six months ago, the stock is still up over 10%. Let’s say you were to have invested in 1,000 shares of PLUG stock on Jan. Here’s a graph that illustrates my point.

Sometimes, the only question that needs to be answered is, what is the cost of doing nothing? In the case of PLUG stock, the question is what you will lose if you don’t jump on the stock right now. There are times when I like to keep investing simple. 2019 Has Been a Choppy Year for Plug Power Stock But does that mean now is the time to get in on PLUG stock? I argue that you should watch and wait. That is a prospect that has investors excited. Plug Power stock could triple if the company hit those targets. The company also recently announced an aggressive plan to achieve $1 billion in revenue and $200 million in adjusted EBITDA. This is good news for a company that has a history of failing to deliver on bold promises. And there are whispers that PLUG may be ready to post another earnings beat. The company has beat expectations in two of its last four quarters. In the case of PLUG however, flat earnings may be a win.

0 kommentar(er)

0 kommentar(er)